A customer service agent can help you navigate the online bill payment services between 6 a.m. You can make payments by phone by calling Indigo’s customer service line at 86. You are also not able to use a debit card to make payments. Unfortunately, there is no mobile app at this time. PST to ensure that it’s credited on the same day. You can also access your monthly bills in the Bill Pay tab, enroll to receive paperless statements, and make payments via direct deposit or bank transfer.īe sure to submit your payments by 5 p.m. To access your account, log in to your account online and click My Account. Be aware that the Indigo Platinum card requires at least a minimum monthly payment of $25 or 1% of your balance, whichever is greater. There are multiple options you can use to make payments on your card. You can even activate your new Indigo Platinum card online. Use Indigo’s website to login to monitor your Indigo Platinum card account activity, pay your bill, view transactions, and check your balance. Indigo Platinum Card Online Account Image Credit: Celtic Bank Generally, secured cards have a credit limit up to the amount of the security deposit you can make. Hot Tip: If you are looking for a card with a higher credit limit, you should consider a secured card. Unfortunately, the Indigo Platinum card doesn’t offer any credit increases, even with a history of timely payments.

Minimum Credit Score and Other Requirements

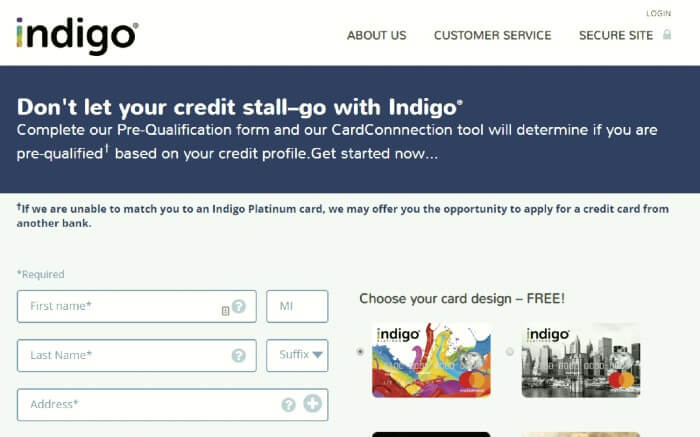

You can securely input all of the required information and even check your pre-qualification status before applying.īy prequalifying, you can check the likelihood that you will be approved, as well as your potential annual fee, therefore avoiding a hard check if you would be declined.īottom Line: Note that to officially apply for a card, you will be hit with a hard inquiry on your credit. To apply now for the Indigo Platinum card, simply head over to the website. Indigo Platinum Card Application Image Credit: Celtic Bank Balance transfers are also not allowed with this card. The maximum credit limit offered on this card is $300, with no credit limit increases offered. You can also use this card to take out cash at an ATM (up to your credit limit), but you will incur cash advance fees of the higher of $5 or 5% each time you withdraw money (after your first year). The Indigo Platinum card is an unsecured card, which means that you have access to a credit limit without needing to put down a security deposit. Hot Tip: You can read more in the Mastercard Guide to Benefits which details all of the program terms and conditions.

0 kommentar(er)

0 kommentar(er)